Since Legalmaster offers so many reports that show accounts receivable information, which one should I use?

The answer depends, of course, on your particular requirements.

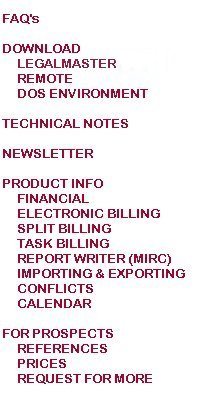

This sample report shows what such a MIRC report might look like. Although you may list every case or client, in the interest of saving space we chose a summarized report, this one by Responsible Attorney. Notice that the column headers are not dates,

they are instead just numbers of days. The right-most column is from 0 to 35,000 days; that's almost 100 years. Notice also that we didn't break out fees from costs; we could have.

A/R by RA1 LEGALMASTER MIRC For Cases 10/14/98 Page 1

Summarized by Responsible Atty

Sort Fields:

Case Responsible Atty 1 Code (Subtotals Only)

0-30 31-60 61-90 91-120 121-35000 0-35000

Ra1 Case Responsible Attorney 1 Name Total A/R $ Total A/R $ Total A/R $ Total A/R $ Total A/R $ Total A/R $

LXM Lawrence X. Miller 2816.85 2423.33 .00 619.65 1806.23 7666.06

LXS Lois X. Smith 3790.50 515.58 732.85 860.59 1582.14 7481.66

LXT Lester X. Tristan 15013.38 10199.64 3759.97 5391.57 4823.68 39188.24

M Manfred 23655.03 11168.19 .00 3407.46 10365.25 48595.93

PHR Phillip H. Rubin 18180.05 4306.03 4784.81 10.99 3731.08 31012.96

------------ ------------ ------------ ------------ ------------ ------------

63455.81 28612.77 9277.63 10290.26 22308.38 133944.85

============ ============ ============ ============ ============ ============

6 records printed.

This is the only report that lets you itemize each outstanding invoice, though you needn't do so if you don't want to see that much detail. You may see totals by matter, totals by client or both.